child tax credit portal update dependents

Since the payments were. Updates that have been made by August 2 nd 2021 will apply to the August 13 th payment as well as any.

Irs Child Tax Credit Payments Start July 15

Half of the money will come as six monthly payments and.

. This tool can be used to review your records for advance payments of the 2021 Child Tax Credit. A nonfiler portal lets you provide the IRS with basic information about yourself and your dependents if you normally. At some point the portal will be updated to allow you to update how many dependants you have.

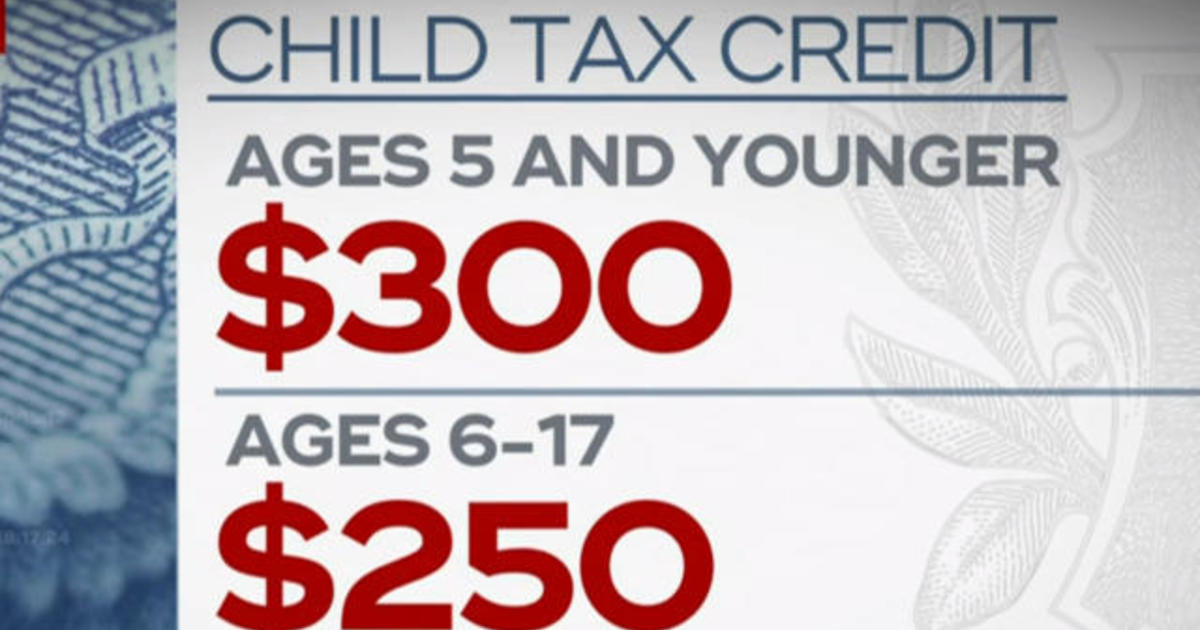

No Matter What Your Tax Situation Is TurboTax Has You Covered. Eligibility for advance payments Bank account and mailing address Processed payments. The IRS will pay 3600 per child to parents of young children up to age five.

Update your mailing address. See Q F3 at the following link on the IRS web site. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account.

Ad The new advance Child Tax Credit is based on your previously filed tax return. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving.

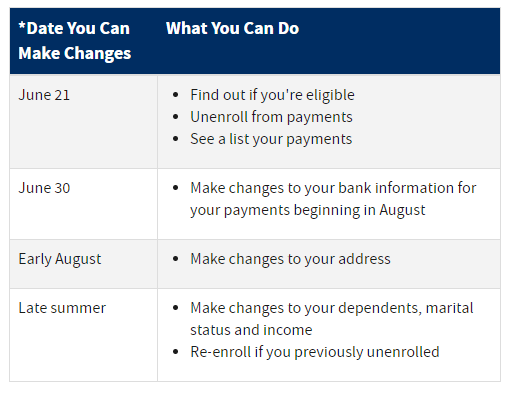

The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child tax credit. Do not use the Child Tax Credit Update Portal for tax filing information. WASHINGTON The Internal Revenue Service today updated frequently-asked-questions FAQs for the 2021 Child Tax Credit and Advance Child Tax Credit Payments to describe how taxpayers can now provide the IRS an estimate of your 2021 income using the Child Tax Credit Update Portal CTC UP.

The Update Portal is available only on IRSgov. Alternatively you can make adjustments eg. A childs age determines the amount.

The IRS launched on IRSgov a Child Tax Credit Update Portal CTC UP to allow you to. If something happens that you are unable to get the payments you can still get the full child tax credit for that child when you file in 2021. The IRS said a new feature will be added to its online child tax credit update portal Monday which will allow payment recipients to update their 2021 income information.

Update your bank account information. Soon the portal will let parents. A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number.

The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving. The IRS is yet to release any information about when it will be possible to update dependent details on the portal.

These FAQs update PDF the Advance Child Tax Credit. If something happens that you are unable to get the payments you can still get the full child tax credit for that child when you file in 2021. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

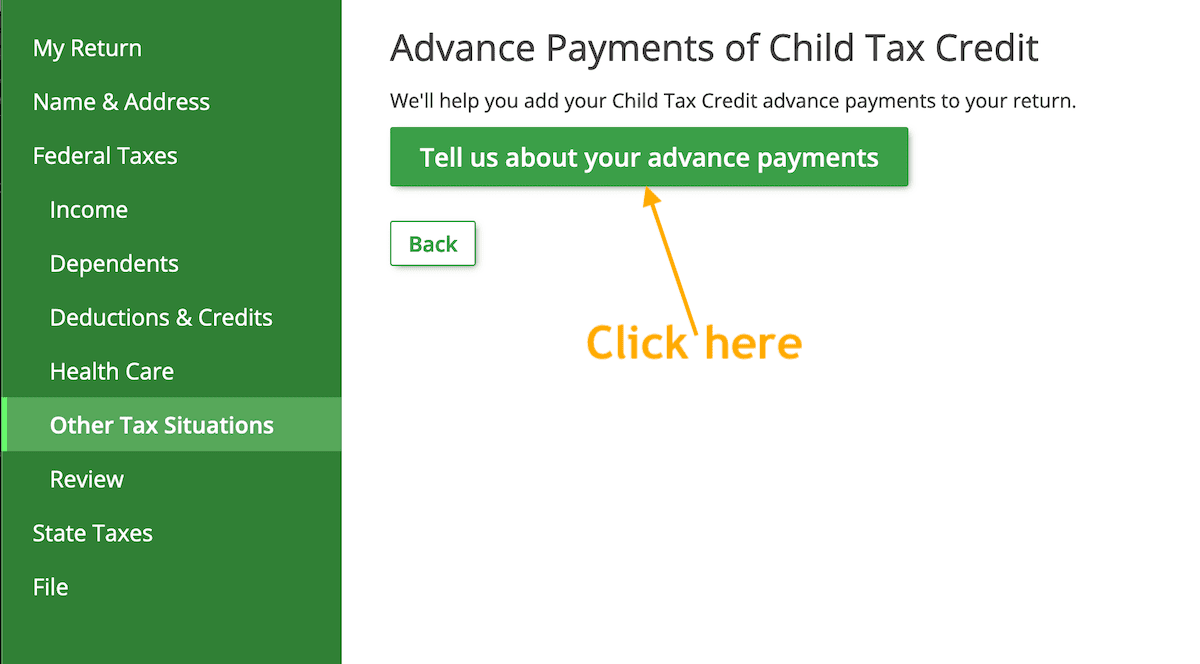

Heres how they help parents with eligible dependents. The advance is 50 of your child tax credit with the rest claimed on next years return. To complete your 2021 tax return use the information in your online account.

Parents income matters too. The IRS says it will be available later this year If you dont get all the payments for your new child during the year you will be able to claim the missing amount as a credit on your 2021 tax return. COVID Tax Tip 2021-167 November 10 2021.

Elect not to receive advance Child Tax Credit payments during 2021. The tool also allows families to unenroll from the advance payments if they dont want to receive them. Updating the portal or any changes next year could also result in an additional payment next year if you were underpaid.

And Made less than certain income limits. The child tax credit is a credit that can reduce your federal tax bill by up to 3600 for every qualifying child. The Child Tax Credit Update Portal allows taxpayers to make sure their household information is correct check payment status and unenroll from the monthly checks.

You can update your number of dependents starting in September. Child Tax Credit Update Portal. Ad More Americans Trust Their Taxes To TurboTax Than All Other Online Providers Combined.

Taxpayers can access the Child Tax Credit Update Portal from IRSgov. To reduce the chances of an overpayment you will be able to update the IRS later this summer about changes to your dependents marital status and income through the child tax credit portal. View the Child Tax Credit Update Portal Use this tool to review a record of your.

June 29 2021 1200 PM The Update Portal for adding a dependent is not available yet.

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Ensuring Families Who Qualify For The Child Tax Credit Aren T Left Behind Code For America

Can I Claim My Elderly Loved One As A Dependent On My Taxes Tax Deductions Types Of Taxes Deduction

Fuller Advance Child Tax Credit Payments

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

No Lines No Waiting You Don T Have To Wait For The Irs Refund At The End Of February Get An Advance Up To 3000 Wh Filing Taxes Accounting Services Tax Time

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Avoid An Irs Audit Debt Relief Programs Irs Tax Debt

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Paying For College Is One Of The Most Common Concerns I Hear About From Students And Parents The Peo Saving For College College Savings Accounts College Costs

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

2021 Child Tax Credit Steps To Take To Receive Or Manage

Did Your Advance Child Tax Credit Payment End Or Change Tas